Bank of America (BOA)

NEWS FLASH -9/16/2024

One Crazy Deal…..

The Sausalito Center for the Arts (SCA) Lease is one crazy deal….

1. The first bit of craziness: The City never issued a Request for Proposal (RFP) for the Bank of America Building Lease. They only issued a Request for “Ideas” (see January 11th City Council meeting Staff report).

2. The second bit of craziness: The Council essentially awarded the Lease to the SCA at a January 11, 2022 Council meeting even after a major component of the SCA’s proposal immediately collapsed. The proposed tenant of a to-be-constructed “rooftop bar” atop the former Bank of America building surprised both the SCA and the Council when he stated at the council meeting that the bar project was not viable.

3. The third bit of craziness: The SCA’s spokesperson wrote in a letter dated February 7, 2024, that “the proposed rent increased from $4,029 to $11,095 per month is self defeating”, not admitting that the increase was specified on page 17 of the lease that the SCA signed in August of 2022.

4. The fourth bit of craziness: In February, 2024, the SCA’s spokesperson/boardmember alleged that other tenants in City buildings are paying as little as $1 per square foot per month for their spaces. At the current rate of $4,029 per month, the SCA is paying just $.70 per foot/month and, with the increase stated in the Lease, would still be paying under $2.00 per foot/month.

5. The fifth bit of craziness: The Staff is apparently relying heavily upon data supplied by the SCA itself in recommending a reduction to $8,058.50 or $1.41 per square foot/month. This places other downtown art galleries at an economic disadvantage as market rates for such space run $4-$10 per square foot/month.

6. The sixth bit of craziness: The second component of rent under the SCA lease is “Third Party Event Rent” which is to be 50% of net event rent above a monthly threshold during the first 18 months of the lease. The SCA makes no mention of ever paying such a rent despite the Center’s much touted “success”.

The craziness began when the City failed to Issue a formal RFP. The City would have gained a true sense of the market value of the property and the lease by reviewing educated proposals from established entities. The City did receive one proposal from such an experienced and established submitter to the Request for “Ideas” but chose to ignore it.

The SCA’s real mission should be to seek donors to assist with the Lease rent, not request further aid from the City and the citizens of Sausalito.

We must continue to hope this SCA transaction is the result of inexperience and naïveté rather than cronyism and corruption.

Please click below to email the City Council. Since they don’t respond to our “form” emails, please add personal comments.

Click here to email the City Council

Instructions to attend meetings by phone, zoom or in person.

NEWS FLASH, February 15, 2024

A LEASE IS A LEASE..

This letter is not averse to the art community. In order for everyone to survive in Sausalito, the City must be fiscally responsible.

The Sausalito Center for the Arts (SCA) has recently circulated a plea for relief from a rental rate increase to be imposed by its big, bad landlord, the City of Sausalito. The SCA portrays itself as the “Victim” in this saga, but the facts tell another story:

The Sales Pitch:

o The City bought the former Bank of America building (the Property) in October 2000, financing the property using a complicated sale-leaseback approach with an annualpayment obligation of $157,000 .

o In the fall of 2021, the City issued a Request for Information (RFI) for ideas as to what to do with the Property. Only six groups responded and only two contained any specific proposals. Surprisingly one of these was a group led by Monica Finnegan, a member of the City’s Economic Development Advisory Committee which had recommended the purchase of the Property and shepherded the submission of the RFI responses.

o Ms. Finnegan’s group, the now-named Sausalito Center for the Arts (SCA), was apparently the only submitter invited to make a presentation to the City Council on January 11, 2022. During that presentation (one hour and 17 minutes into the Council meeting), Ms. Finnegan clearly stated that her group “could cover the City’s debt service”, the annual $157,000 noted above.

The Lease

o The City awarded the opportunity to SCA and a lengthy lease negotiation ensued. Attorney Ron Albert represented SCA in the negotiations. A summary of the negotiated lease terms was posted in Currents. A lease was executed between the City and the SCA. The lease contains the following provisions regarding SCA’s rental rate for the Property:

Square footage: 5,725

Initial Monthly Base Rent (first 18 months): $4,029

Rent Increase at Month 19: 7,066

Monthly Base Rent for Balance of Term: $11,095

Annual Base Rent ($11,095 X 12) 133,143

Annual BofA ATM Lease Payment 24,000

Total Rent Payments $157,143

City’s Annual Finance Obligation $157,000

The Conclusion

o The SCA’s claim that the City is unilaterally going to increase SCA’s rent ignores the terms of SCA’s lease with the City. SCA was represented by Counsel during the lease negotiation. SCA was not and is not a “Victim:” The lease terms for rent and other performance benchmarks were mutually agreed upon by SCA and its attorney.

o There is no reason for the City (and indirectly us taxpayers) to be subsidizing SCA for an additional $84,000per year. We’ll be losing nearly $250,000 a year in parking revenue due to the “redesign” of the Ferry parking lot. Isn’t it time to save money instead of lose it? Let’s give the taxpayers a break!

**NEWS UPDATE 12/2/22

The rooftop bar, operated by Poggos, was an integral part of the Sausalito Center for the Arts (SCA) proposal to rent the Bank of America Building. Here is Councilman Sobieski’s response when I asked about the status of that important element of the lease:

Kate Flavin <kflavin129@gmail.com>

Sat, Nov 19, 11:26 AM (13 days ago)

to Ian, Ian

Dear Ian,

Apparently the City Council is unaware the BOA Rooftop Bar will not be built/ operated by Larry Mindel. A simple request to Poggos confirmed this. Given your financial background, I would like to know how this news affects the BOA lease vis a vis the City budget. I think as citizens, we have a right to know how our tax dollars are spent. I look forward to your timely response.

Thank you

Kate Flavin

Here is Council member Sobieski’s response:

From: Ian Sobieski <ian4sausalito@gmail.com>

Date: November 19, 2022 at 10:07:36 PM PST

To: Kate Flavin <kflavin129@gmail.com>

Subject: Let's meet in person in front of a crowd.

Hi Kate-

I am genuinely sorry to say this after two years of trying to connect with you: I simply don’t trust you to be a fair or accurate conveyor of information to the people who are on your mailing list and who trust you.

You say you want “accurate information” but your website, HeyCityCouncil is a paragon of half truth, partial information, and cynicism that, in my opinion, undermines the good governance of our town and the welfare of our people. To represent that you’d like to “ convey accurate information ” is simply not credible with me. You have a demonstrated track record of doing the opposite.

Our politics nationally have many players (Fox News, Donald Trump, Breitbart, etc.) who use partial information to promote confusion and bolster a narrative that promotes anger and squashes understanding. I believe you are playing a similar role in Sausalito. I have concluded that your effort and interest is primarily devoted to increasing confusion, disorder, and ill-feeling; rather than increasing understanding, and promoting collaborative problem solving. I am genuinely sorry to say this is my conclusion after two years of trying to engage with you as the leader in the community that you are. You could be such a force for good in world; I wish that you would choose to be. I call on you to at least stop. Stop hurting Sausalito and her people.

I would discuss all this with you in person, of course; but you have turned down numerous invitations from me, over two years, to meet in person and discuss anything. I’ll let others draw conclusions as to why.

Because I don’t trust you, and think you approach me and others in bad faith, I don’t think emailing me questions is productive since I can’t be confident you will fairly and accurately represent those answers to your circle of trust.

To be sure what I say has a chance of being accurately heard by those people I feel you are confusing and misleading, what I offer is this: I will meet you in a public session for a *two way* discussion (where we get to ask each other questions) concerning all matters concerning Sausalito *if* at least 30 of your mailing list is in physical attendance.

Sincerely,

Ian SobieskiKate Flavin <kflavin129@gmail.com>

Sun, Nov 27, 11:35 AM (5 days ago)

to Ian, Ian

Dear Ian,

I do not want to engage with you in an exchange of personal insults. We clearly see things differently regarding good governance and community benefit.

You speak of good governance, and, in Sausalito, I see:

o a consistently undermanned police force;

o a fire department over which the City has no authority nor financial control; and

o a City budget consistently in the red.

What you tout as actions for the community benefit, I see as either ill-managed or acts of desperation:

o A $1.35 million contract in early 2021 with Charlie Francis to “fix” the City’s financial morass; when in-house professionals apparently realized his “fix” was nothing more than a bookkeeper could have accomplished, the Francis contract was terminated in November 2021. That only cost us $700,000 - not much of a community benefit.

o The hiring of a law firm without an open rfp or bid or discussion of the qualifications of the personnel assigned to us. Do you know how much that is costing us in direct and indirect fees? Every time I see the firm’s multiple attorneys at Council or Commission meetings, I hear a big “Ka-ching” in the back of my head. Now one of the firm’s partners has been elected to the City Council. How do you propose to deal with that apparent conflict? Exactly how is the community benefiting from this arrangement?

o The acquisition of the former Bank of America building might have actually been a good move for the community…until the Council burdened the value of the property with a substantially below market lease to the Sausalito Center for the Arts, an organization replete with former, and possibly even some current, mayors and committee members, and without any history or track record. Apparently, no one on the City side of this negotiation understood that appraisers value current rents more highly than possible future ones. Sad.

o An apparently poorly managed interaction with PG&E regarding the possibility and process of undergrounding of PG&E utilities vs the PG&E plans to upgrade service without under-grounding. As a resident, it seems to me that any meaningful advisory to the community should have started with:

§ A reasonable range of “per residence” costs for such an under-grounding, with an express acknowledgement that costs could go higher; and

§ Advice that this process is delaying PG&E’s implementation of a $8 million upgrade to PG&E’s equipment in Sausalito.

The City’s current survey of residents regarding the under-grounding is flawed in many ways and borders on disinformation. The City has been in discussion with PG&E on this matter since late 2020 and the matter could have been resolved soon after that by advising residents of an estimate of the per resident cost.

· You have proposed a meeting with 30 “of my people” present, obviously to be organized by me for your benefit. Wouldn’t this violate the public meeting policy preventing in-person City Council meetings? If not, why not open City Council meetings? Or organize your own “meet and greet” open to all interested residents?

· Finally, I did meet with you at the Sausalito Bakery on Bridgeway which several residents witnessed, after the 2021 meeting at Angelinos regarding the ferry plaza design. I came away from that meeting with nothing of substance, and have no desire for further private meetings.

Sincerely,

Kate Flavin

from: ian Sobieski <iansobieski@me.com>to:Kate Flavin <kflavin129@gmail.com>

date:Nov 29, 2022, 6:14 PMHi Kate—

I offered to discuss any and all of these things in front of at least 30 of the people who trust you because I do *not* trust you to accurately convey what I say to them. This would hardly be a friendly audience for me; but I offer it in the hope and belief that the information you refuse to convey to them would help balance the narrative they have been receiving from you; and might attenuate their anger with the facts and nuance you choose not to convey.

Perhaps this is why you are reluctant to organize such a discussion; because it risks undermining the anger you have been investing in? Do you actually want to help solve Sausalito problems or is your primary objective to feel and express anger?

I will expand my offer, a regular monthly discussion with you in front of 30+ from your mailing list, if they and you attend in person.

And, a case in point of your misleading rendition of facts is the assertion that sitting at a Sausalito Bakery Cafe while I spoke to your table mate for less than 3 minutes constitutes a “meeting with me”. By that measure I had a “meeting with Queen Elizabeth" in Canada in 2002 when I stood by her in a rope line. For the record, again, over the past two years you have declined numerous invitations to speak on the phone or meet in person with me. We can let others conclude the reason why.

Ian

**NEWS UPDATE 8/30/22

We have begun to refer to the now executed and approved lease between the City of Sausalito and the Sausalito Center for the Arts (“SCA”) as “the Bosom Buddy” agreement. Why? The City has bent over backwards with:

1. Far below market rental rate.

2. The expediting of approvals (just ask the normal people caught in Sausalito’s approval swamp!)

3. Leaving the definition of “art” to the discretion of the tenant (apparently the sentiment was “I don’t know what art is but I’ll know it when I see it”). Use your imagination….

4. Allowing the silly process of the City nominating five possible members to the SCA board and then allowing the SCA in its absolute discretion to JUST SELECT THE ONE THE SCA BOARD WANTS. Do you think they might pick a friendly?

5. Allowing SCA to execute a license agreement to a third party for the entire space for up to fifteen days AND THEN present the agreement to the City which can’t disapprove the license. What could go wrong? Another short-term competitor for besieged downtown retailers? They can pick anybody!

6. A Phase I tenant improvements milestone WHICH IS NOT DEFINED and for which ALL CONSTRUCTION FEES HAVE BEEN WAIVED!

7. The City limiting an audit of the Tenant to once a year. No opportunity for funny business there??

The frequent appearance throughout the lease of the term “City approval will not be unreasonably withheld”. And, as icing on the cake, designating two limited provisions which dictate the specific reasons why the City can or cannot terminate the lease. These approval provisions set the stage for an SCA lawsuit if it doesn’t get its way.

We believe, we have not seen the end of the SCA maneuvering. They’ll be seeking approval to build housing on the site at some point.

**NEWS UPDATE 8/2/22

The shenanigans continue. The City executed a License Agreement with the Sausalito Center for the Arts (SCA) ostensibly for 120 days at a total “Compensation” of ONE DOLLAR ($1.00) for physical examination and the holding of events. A closer examination of this license document reveals that the term could be extended up to 12 months or more with no clarity as to any adjustment to the ONE DOLLAR ($1.00) Compensation. A current application to the City for the right to conduct events under the license is requesting a 364-day approval.

The revised full lease will be reportedly available for signature in the next week or so but why would SCA proceed to sign this lease now? If it did, it would trigger the rent payment as well as the fundraising, construction, and administrative milestones. The license agreement has a paltry Compensation amount and no milestones so why wouldn’t SCA stretch the license out as long as possible?

**NEWS UPDATE 7/9/22

CRONYISM 2.0

Here is a letter John Flavin will send to the City Council outlining the appalling terms of the BOA lease with respect to the City. If this lease prevails, the BOA building will lose significant value and so will our City coffers:

Dear Council Members:

You cannot proceed to approve the proposed lease for the Bank of America Building (“BofA Building”) with the Sausalito Center for the Arts (“SCA”) for the following reasons:

1. You will set a precedent that members of City commissions, committees, and the like will receive favored treatment in City bids. Monica Finnegan was part of the City’s Economic Development Committee which recommended to you the purchase of the BofA Building and now, after a relatively bizarre selection process, you propose to award her group the lease. Smacks of cronyism and gives the appearance of a conflict of interest. At a time where the city needs to recover the lost public trust, this is not the time to demonstrate yet another conflict of interest.

2. You will be endorsing the understatement of the total expense of the City’s financing on the BofA building (see Attachment 1). The Staff Reports footnote comment “1 Principal pay down is not included in this analysis because it is a cost associated with acquisition of the asset” is nothing but a word salad full of hogwash.

The Staff Report regarding the approval of the lease states:

“E. Rental of $4,029.23 per mo. covers all debt service (interest) under the financing lease obtained in connection with the Property. During the 10-year initial term of the SCA Lease, this amounts to $483,507.60 of rent which covers more than all of the interest under the financing;

F. SCA also helps pay down a portion [emphasis added] of the principal component (amortized purchase price) of the financing lease over time. During the 10-year initial term of the SCA Lease, this amounts to $288,000 of rent which will reduce the City’s $1,858,000 obligation under the financing;

According to the Staff Report to the Council meeting on January 11, 2022, the Council’s own working group of Council members Hoffman and Sobieski had the following as one of the criteria for awarding the lease:

“3. The time between execution of a lease and being able to pay a rent sufficient to cover or exceed the city’s financing cost of the building (Initial interest payments are $5,614 and initial principle (sic) payments are $7,499, for a total payment of $13,114/month [emphasis added]; as the payments progress more and more of the payment is toward principle and less toward interest until the loan is fully paid off).”

At the same meeting in January, Ms. Finnegan states that her group “could cover debt service (Timing: hour 1, minute 17, second 57). The term “debt service” is defined as “the cash that is required to cover the repayment of interest and principal on a debt for a particular period” [Investopedia; Merriam Webster]. Ms. Finnegan is an experienced real estate professional in partnership with her husband, former mayor Mike Kelly, and would understand the meaning of the term “debt service”.

The recent Staff Report strikes me as misleading when the author asserts the SCA rental payment of $4,029.23 would reduce the City’s Holding Cost to “$0”. This rental amount is less than “Initial Interest Payment” of $5,614 noted above and does not in any way cover the principal payment of $7,499. The term “holding cost’ appears to be employed to allow the ignoring of the principal repayment.

What happened between January and July to reduce the rent by two thirds?

3. You will be party to a grossly under market lease that, given its 10-year duration with extension options, will dramatically reduce the value of a City property. The $4,029.23 monthly rental rate on 5,875 rentable square feet equates to $0.69 per square foot per month or $8.23 annually. A quick review of Keegan & Coppin’s report on available retail space in Southern Marin has no asking rent under $1.25 and some as high as $3.00. Committing to a long-term lease at 40% to 80% discount from market will severely hamper the building’s value.

The current Staff Report’s attempt to comfort you with:

‘It is important to note that entering into either lease would not preclude a future sale of the Property, provided that City would need to comply with the Surplus Land Act. If no government agency required to receive notice under the Surplus Lands Act is interested, a future private buyer would simply assume the leases [emphasis added], and net operating income, as part of the sale.

In other words, you would be free to sell the building at a below market price due to the below market rent. Not what a fiduciary is supposed to do.

And guess what? Under Section 31 of the lease, SCA would have a first right of refusal to purchase the building at the reduced appraisal value. In short, SCA cuts the value of the building by its low rental rate and then can swoop in and buy the building at the impaired price…doesn’t pass the sniff test.

4. There are other provisions in the lease that raise even more questions. Take Section H under Key Financial Provisions in the recent Staff Report (see Attachment 2). SCA is recognized as “a startup” with minimal financial reserves and so the City could be on the hook to fund major repairs. To add insult to injury, SCA would then amortize this City funding “over the life of the repair or replacement at 0% interest” [emphasis added]. This could be very expensive generally but, given the loose language of this section, it could be punishing if the proposed roof top deck construction somehow triggers this provision.

IN SUMMARY: You need to take a hard look at the surrounding circumstances. Now is not the time to be subsidizing “nice” uses. You have been running operating deficits for three years and are budgeting to do it again. That’s the definition of a crisis!.

This below market deal on the BofA will economically hurt the very merchants you should be assisting. Rumor has it you are considering cutting the hours for a number of City employees, reducing services to the residents and hurting low level workers who are already suffering in the current economy. What a morale buster!

Don’t lease the BofA Building…sell it! You keep saying it has markedly appreciated, so sell it and use the proceeds to pay off the “loan” and the balance can go towards operations. Listen to your constituents and, by doing so, you may rebuild public trust.

John Flavin

Resident

**News Update, 7/4/22

You decide if the BOA lease negotiations reek of cronyism.

1. Appearance of Conflict of Interest

Monica Finnegan, a real estate developer and founder of the Sausalito Center for the Arts (“Arts Center”), was a member of the Economic Development Advisory Committee (EDAC) at the time EDAC recommended the Council purchase the Bank of America Building (BOA). Monica is married to Mike Kelly, the former mayor who is a real estate developer and her business partner.

Tom Reilly, the then temporary City council member and now chair of EDAC, submitted an endorsement letter of the Arts Center and was identified in the Arts Center’s proposal as a potential member of the Arts Center Advisory Committee.

2. Limited Competition to Rent the Building

The City of Sausalito requested “ideas” for the BOA use. Six groups responded with “ideas”. The City only contacted one other respondent in addition to the “Arts Center” group about its plan to rent the BOA space. The City’s discussion with this other group never addressed specifics.

3. THIS IS WHERE IT GETS INTERESTING

a. City staff has been negotiating with the Arts Center for a BOA lease since January 11, 2022

b. The City has recently executed or intends to execute a license agreement for 120 days to the ARTS CENTER (Monica Finnegan) FOR $1 (ONE DOLLAR) but specifically states “WHEREAS, City and Licensee are in the process of negotiating a lease (“Proposed Lease”) for a five thousand eight hundred seventy-five (5,875) square foot portion, being the ground floor and the mezzanine of the former Bank of America building located at 750 Bridgeway, Sausalito, California (“Property”), the final approval of which remains subject to the independent review, consideration and approval by City’s Council [emphasis added];

d. Under the License, the Arts Center can “use the Property for the purposes of:

· performing due diligence site assessments such as architectural, engineering, contractor and similar investigations; and

· conducting the fund-raising and other events described in Exhibit A, as well as other events from time to time, subject to the prior approval of the City Manager.”

SUCH A DEAL

The City of Sausalito (with a huge budget deficit) allows the Art Center (a newly formed organization with no track record headed by a real estate developer) to pay $1 for four months of use. This choice of tenant contradicts the City Council’s Subcommittee which notes these criteria for a BOA tenant:

o The applicants' track record of executing projects similar to that proposed

o The time between execution of a lease and being able to pay a rent sufficient to cover or exceed the city’s financing cost of the building.

To add insult to injury, the EDAC Committee conducted a city- wide survey asking residents how the BOA Bldg should be used. Community Center and Artist Collective were low on the list.

HOW WOULD YOU DESCRIBE THESE NEGOTIATIONS?

**News Update 2/4/2022

Bank of America Bldg.

The City Council reviewed one proposal for the use of the downtown Bank of America (BofA) building at its January 11th meeting. The building was purchased by the City of Sausalito in October 2020 for $2,000,000. Despite efforts by the City, the building has been vacant over the past 18 months accruing an additional $350,000 in costs, according to council members at the council meeting.

· After the acquisition of the building the City issued a formal Request for “Ideas".

o The city received six submissions (see Attachments 1-6 under Item 4C on the linked Agenda) in response including nine alternatives for use of the building.

o A working group of Mayor Hoffman and Councilman Sobieski were assigned to review them with staff and make a recommendation.

· At the January 11th meeting, Hoffman and Sobieski presented only one applicant, the Sausalito Center for the Arts, to the balance of the council.

o The Sausalito Center for the Arts Proposal (“the Center”) is lengthy and detailed.

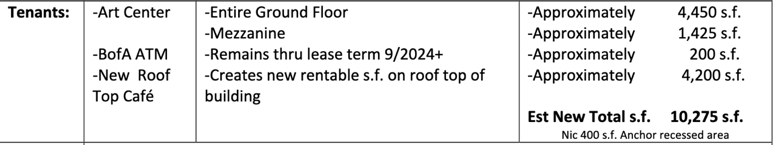

o The Center’s proposed tenant mix Is:

o Monica Finnegan made the initial pitch for the Center followed by Louis Briones .

o A key attraction and economic component of the Center was the new 4,200 square foot roof top bar ostensibly to be run by Larry Mendel of Poggio and Copita fame. However, at the Council meeting, Mendel reported that the roof top bar would be terribly expensive to build and that the numbers “did not pencil out”. In other words, in Mendel’s judgment the roof top bar was not a viable concept.

o Mendel’s conclusion put a damper on the presentation but the Council members tried to revive the enthusiasm by saying things like:

§ The project might evolve over time to a point at which the roof top bar would be viable;

§ The project could survive without the roof top bar;

§ Other benefits to the City could come from the Center, such as increased transient occupancy taxes from people staying at local hotels to attend Center events; and

§ The BofA building is an appreciating asset and the value will always go up, like house prices in Sausalito.

· No decision was made at the meeting other than to instruct staff to begin negotiations with the Center’s team for a lease on the property. Final approval was reserved to a later meeting.

· Financing: How the City financed the purchase is not transparent:

o According to the City Staff, the city financed the purchase price of the building with 2.79%, 15-year loan with a monthly mortgage payment of $13,114 per month. Staff Report for January 11 2022 Council meeting

o However, attached to the BofA agenda item for the Council’s January 11, 2022, meeting is a “lease schedule” which has:

§ The same interest rate and term as the loan in the staff report; but

§ The payments are made every six months; and

§ The principal repayments do not follow a standard amortization schedule.

The author of the lease schedule is none other than Charlie Francis which no doubt explains the “creative” structure.

o Whether the arrangement is a lease or a mortgage, the economic terms are spelled out in the “lease schedule”. What is still not known is whether the City itself or some third-party entity or a combination thereof was the source of the $2,000,000 purchase price.

End of Update

8/2020-Beware of Politicians with “Vision”

The City Council has admitted at various points that they were essentially in a multi-faceted fog when they bought the Bank of America (“BOA”) building last October for $2 million.

Fog 1: For five years, the city’s auditors Maze & Associates have been formally notifying the City of sloppy accounting practices (Maze & Associates - “City of Sausalito Memorandum of Internal Controls”, not available on the City website). How were the Councilmembers sure they had available funds for the purchase?

Fog 2: Then Councilmember Joe Burns admitted the City had no real plan to finance the building long- term. Burns said:

“…on financing -want to get the deal completed; best to take money from the general fund, then refund the general fund with maybe a municipal bond or a taxable note…”

Fog 3: The City had no idea how to use the building once purchased:

○ On April 30, 2021, six months after the building’s purchase, the City issued a Request for Ideas to “entities equipped and capable of executing their ideas”.

○ Responses were due August 31, 2021 but the City made an error. The deadline has been extended to September 30, 2021, with a Bidder’s conference on September 10 at 10:00am (Zoom link to conference).

○ The building remains empty except for the ATM machine but the City has budgeted $160,000 in revenue from the property for the 2021-2022 fiscal year which began July 1, 2021.

Did the Sausalito City Council understand what they were getting into?

The Bank of America building is far from typical office or retail space:

The first floor is 4,450 square feet and the second floor is 1,425 square feet. If you watch the City's virtual tour, you will see the first floor is an open space with counters and small offices and the second floor is a rabbit warren of apparent storage areas.

There are only windows on two sides of the first floor and none on the second.

During public comment at a Council meeting, local resident Peter van Meter opined either the City or a new tenant would have to spend an additional $500,000 to $600,000 to make the space ready for occupancy. BofA Presentation at August 18, 2020, CC Meeting -one hour, 30 minutes into the session

The best face of the building along Bridgeway is encumbered by the BOA ATM;

Pros and Cons of the ATM lease:

Pros:

The ATM occupies 150 square feet in the building and pays $2,000 per month rent;

Cons:

The building cannot be leased to another bank;

The ATM space is entitled to “quiet enjoyment” which essentially means any renovation work in the building will require approval by BOA. Sounds minor but such negotiations consume time and money;

The ATM space cannot be moved without BOA approval. Again, negotiations would consume time and money.

Do the numbers make sense? Is the “Lease Potential” significantly overestimated?

Potential Revenue:

Staff made a Presentation to the City Council on August 18, 2020 and used market commercial office rent figures for projecting potential revenue from the building.

None of the Top 10 uses from the resident survey involved commercial office use.

Since market office rates have been running higher than retail ones, this skewed the financial analysis in favor of a “buy”. Cushman & Wakefield Market Beats.

“If you torture the data long enough, it will confess to anything”

Ronald H. Coase, a renowned British Economist

Purchase Price:

The $2 million purchase price equates to $340 per square foot if you consider the total building and $449 per square foot if you include only the first floor;

Recent office building sales in Marin County range from $254 to $280 per square foot;

Bank of America didn’t give away the property, particularly since most buyers would discount the property due to the potential headaches with the ATM lease.

Financing the Building

Current Financing details of the existing financing have not been disclosed except for the reference in the current city budget of a $160,000 cost per year, or $13,333 per month. Financing possibilities:

Private Sector Mortgage:

Until a lease has been signed, there is little chance of securing a private sector mortgage;

Bond

Borrowing capacity: not sure where the City stands regarding borrowing capacity;

If a bond can be floated:

It would require voter approval; and

It would undoubtedly be a General Obligation bond which would allow the City to pass the cost on to the taxpayers.